- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

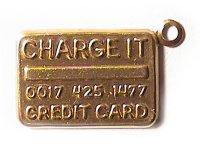

The first bank cards appeared in America in the late 19th century. They were made of cardboard and served only to confirm the creditworthiness of the owner outside the bank. In 1914, Western Union issued the first card with a fixed amount of credit for each customer. Ten years later, short-lived paper cards were replaced by metal cards with embossing. They embossed (ie squeezed out) the card number, name and address of the client. The use of such cards allowed to automate the payment process, since the data from the embossed card could be printed on checks and receipts by means of a special press.

The beginning of bank credit cards was put by John Biggins, a specialist of the Brooklyn National Bank Flatbush. He organized a system of payment on receipts, which were accepted by shops from buyers for small purchases. Then the outlets gave these receipts to the bank, which paid them out of the buyers' accounts.

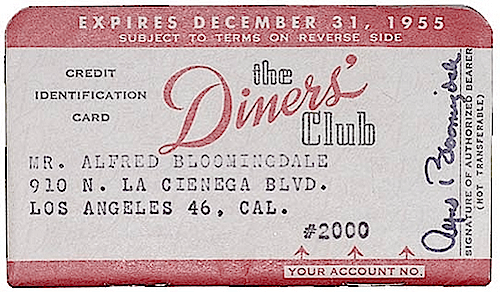

And in 1946 the company Diners Club created the first mass card system. Its main difference from previous systems was the presence between the buyers and sellers of an intermediary, who took over the calculations. This concept appealed to customers, and in a year 285 trading companies served 35 thousand cardholders. Diners Club regularly charged its customers for an annual maintenance fee of $ 3.

Over time, the use of cards began to go beyond America. So in 1951, Diners Club granted the first license to use its system in the UK. Several years later, American Express and Bank of America launched their card systems. The latter was called BankAmericard, and 20 years later it was renamed VISA.

In 1960, the first plastic card was created. Its feature was the presence of a readable magnetic strip, and 15 years later it received electronic memory.

Modern bank cards are made of polyvinyl chloride, but some premium cards can be made of metal. In the cards, as a rule, there is a magnetic strip with one, two or three data tracks. It duplicates the information displayed on the surface of the map, the same magnetic strip is designed for automated processing of cards. It is worth noting that you can determine the payment system by the first digit of the card number. So, the figure 4 corresponds to Visa, and 5 - to MasterCard. And the first 6 digits form the identification number of the bank, which is issued by the payment system and is unique.

The chip cards have a special EMV chip, which is responsible for verifying the transaction on compatible ATMs. The check is made at the hardware level: the ATM generates the number to which the chip should give the correct answer.

Also, modern plastic cards may have a chip and an RFID antenna for contactless card reading. Hardware RFID has nothing to do with the operation of the EMV chip and the magnetic layer. In addition, the RFID chip number used to make payments is not related to the number on the plastic or magnetic stripe. Communication occurs only through bank servers, where credit card numbers and an RFID chip are associated with a single account.

The article is based on materials .

- Get link

- X

- Other Apps

Comments

Post a Comment